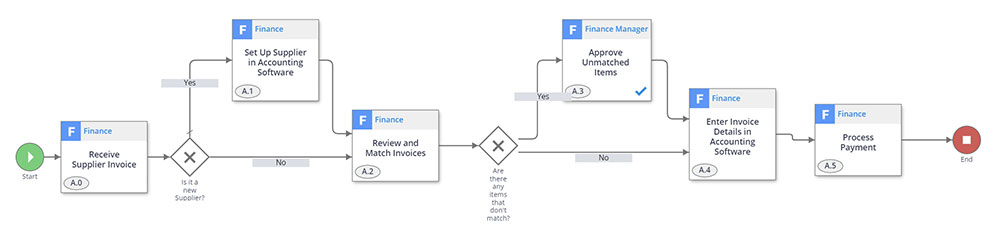

Process an Invoice

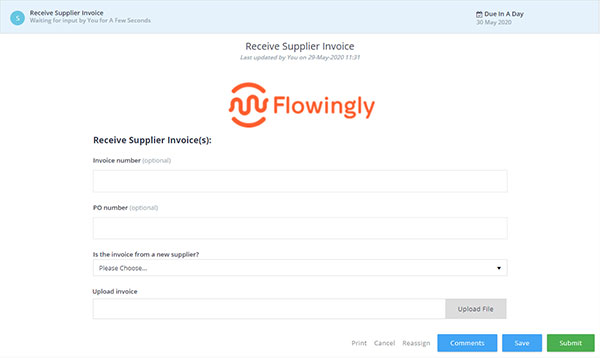

1. Receive Supplier Invoice Finance

Different organizations will receive their invoices differently, but they commonly arrive to a shared mailbox. This step sees a member of the Finance team record the invoice number and PO number if known. They also indicate if the invoice is from a new supplier.

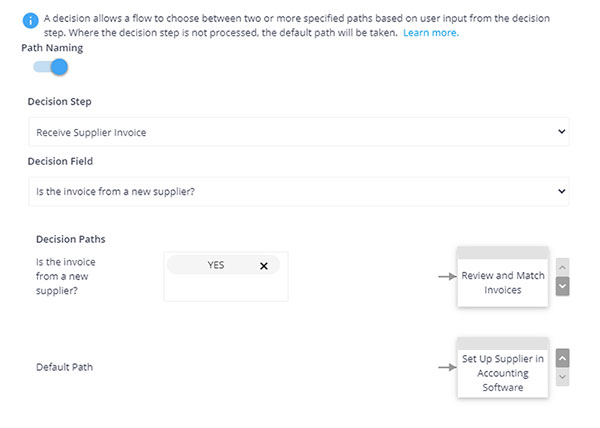

2. Is it a new Supplier? Decision

If the invoice is from a new supplier, the Finance team are prompted to set them up in the accounting software.

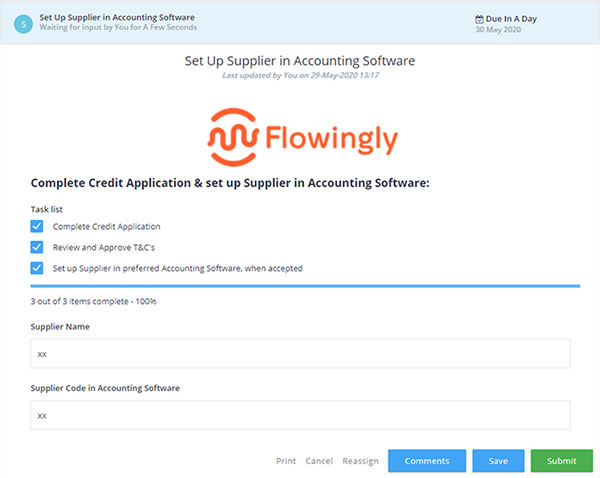

3. Set Up Supplier in Accounting Software Finance

In this step, the Finance team apply for a credit trading account with the supplier. They then add the supplier to accounting software. Some organizations may wish to include an additional step to add the supplier’s information to the intranet for the benefit of non-finance staff.

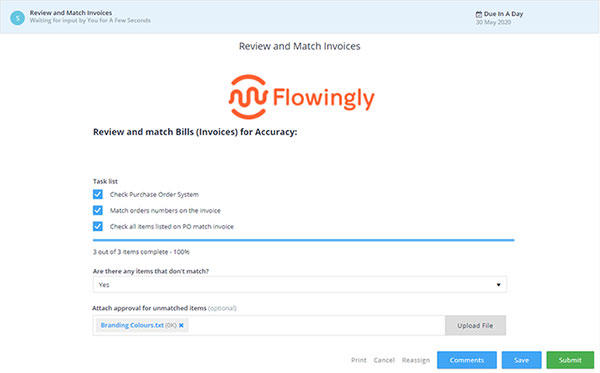

4. Review and Match Invoices Finance

The Finance team member can now review the invoice and compare it to the purchase order. Now is the time to record is a difference exists in the items, price, or quantity. If the invoice cost is higher, the staff member must attach a form of approval from the respective cost center.

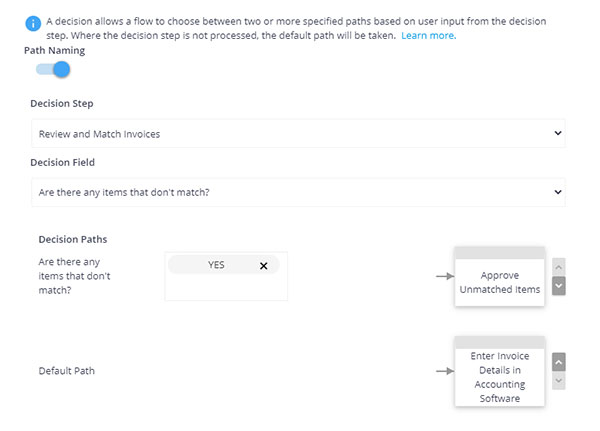

5. Are There Any Items That Don’t Match? Decision

If there is a mismatch between the invoice and PO, this is escalated to the Finance Manager for approval.

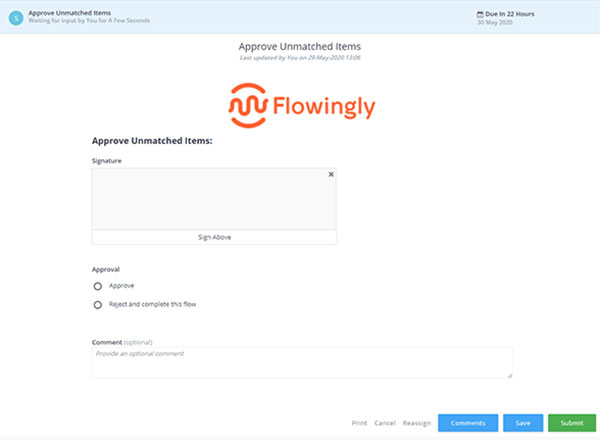

6. Approve Unmatched Items Finance Manager

Though some organizations may not explicitly require this supervisor approval, many see it as an unfortunate but necessary precaution against embezzlement. In this step, the Finance or Accounts Payable Manager can review the invoice, PO and approval documentation if required.

7. Enter Invoice Details in Accounting Software Finance

Once the invoice and PO have been matched, the Finance team member can enter the specifics into the accounting software to schedule payment.

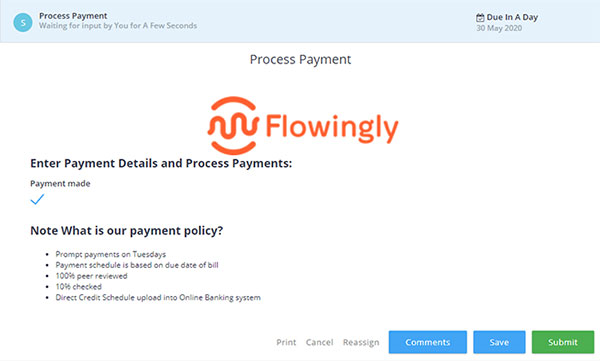

8. Process Payment Finance

Finally, once the payment has been made, the process is complete.